Introduction

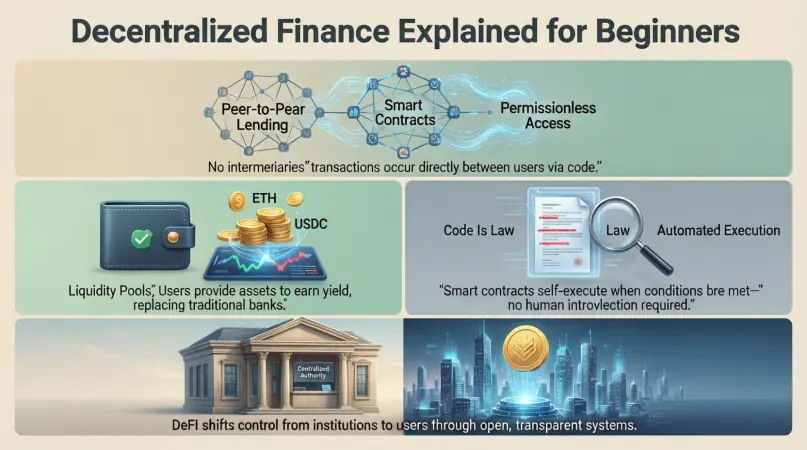

Decentralized Finance, often called DeFi, is changing the way people think about money, banking, and financial services. Instead of relying on traditional banks or financial institutions, Decentralized Finance uses blockchain technology to give users direct control over their assets. This shift is important because it removes middlemen and opens financial access to more people worldwide.

In simple terms, Decentralized Finance allows anyone with an internet connection to save, borrow, lend, trade, or invest without asking permission from a bank. Everything runs on smart contracts, which are automated programs that follow predefined rules. As a result, transactions become faster, more transparent, and often cheaper.

What is Decentralized Finance?

Decentralized Finance is a financial system built on blockchain networks. It removes centralized authorities like banks, brokers, and payment processors. Instead, it uses smart contracts to manage transactions automatically.

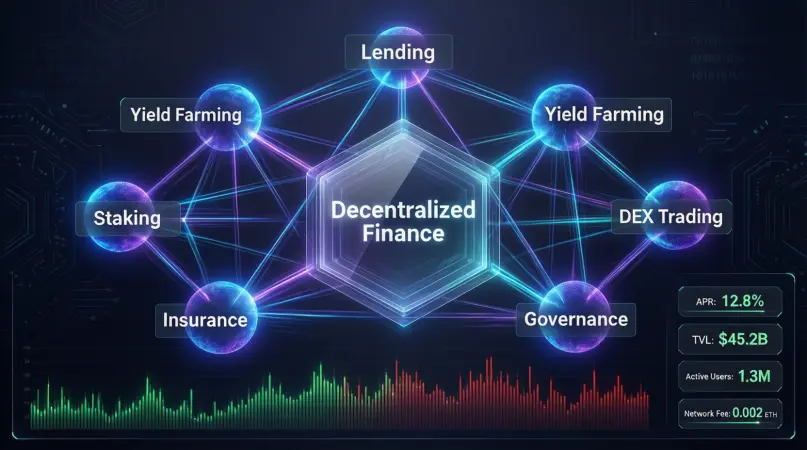

In Decentralized Finance, users interact directly with financial applications called dApps. These apps handle lending, borrowing, trading, and investing without human involvement. Everything is recorded on a public blockchain, making it transparent and secure.

Traditional finance depends on trust in institutions. Decentralized Finance depends on code and cryptography. This difference allows users to keep control of their funds at all times. No single entity can freeze accounts or block transactions.

Why is Decentralized Finance Important?

Decentralized Finance is important because it increases financial freedom and accessibility. Many people around the world cannot access banks due to location or documentation issues. DeFi solves this problem.

It also reduces costs by removing intermediaries. Transactions are often faster and cheaper than traditional banking services. In addition, transparency helps reduce fraud and corruption.

Decentralized Finance encourages innovation. Developers can create new financial products quickly without complex approvals. This open environment leads to constant improvement and competition.

Detailed Step by Step Guide

Step 1: Understanding Blockchain Basics

Before using Decentralized Finance, you need to understand blockchain basics. A blockchain is a distributed ledger that records transactions securely.

Each transaction is verified by the network. Once added, it cannot be changed. This feature ensures trust without a central authority.

Step 2: Setting Up a Digital Wallet

A digital wallet stores your crypto assets and allows access to DeFi platforms. Choose a reliable wallet that supports decentralized applications.

After installation, secure your recovery phrase. This phrase is the only way to restore access if you lose your device.

Step 3: Acquiring Cryptocurrency

Most Decentralized Finance platforms use cryptocurrencies. You need to purchase some from an exchange and transfer them to your wallet.

Always double check wallet addresses. A small mistake can result in permanent loss.

Step 4: Choosing a DeFi Platform

Select a Decentralized Finance platform based on your goal. Some platforms focus on lending, while others offer trading or yield farming.

Read the platform details carefully. Understand fees, risks, and supported assets.

Step 5: Using Smart Contracts

When you interact with DeFi platforms, you approve smart contracts. These contracts execute transactions automatically.

Once approved, actions like lending or swapping happen instantly based on code rules.

Step 6: Monitoring and Managing Assets

Regularly check your assets and transactions. DeFi markets change quickly, so staying informed is important.

Use dashboards or portfolio trackers to monitor performance and risks.

Benefits of Decentralized Finance

- Full control over personal assets

- Open access for anyone with internet

- Lower transaction costs

- High transparency through blockchain records

- Faster transaction processing

- Innovative financial products

- Global participation without restrictions

Disadvantages / Risks

- Smart contract vulnerabilities

- High market volatility

- Regulatory uncertainty

- Risk of scams and fake projects

- Limited customer support

- Technical complexity for beginners

Common Mistakes to Avoid

Many users rush into Decentralized Finance without proper research. This leads to losses and frustration.

Avoid investing more than you can afford to lose. Crypto markets are highly volatile.

Never share private keys or recovery phrases. Security mistakes are common and costly.

Ignoring transaction fees is another mistake. Fees can reduce profits significantly during busy network periods.

FAQs

What makes Decentralized Finance different from traditional finance?

Decentralized Finance removes intermediaries and relies on smart contracts instead of banks.

Is Decentralized Finance legal?

Legality depends on local regulations. Users should check their country rules.

Can beginners use Decentralized Finance?

Yes, with basic knowledge and careful steps, beginners can use it safely.

Are DeFi platforms secure?

Security depends on code quality and audits. Risks still exist.

How can I earn from Decentralized Finance?

Users can earn through lending, staking, or yield farming.

What happens if I lose my wallet keys?

Funds are permanently lost. There is no recovery option.

Expert Tips & Bonus Points

Start small when exploring Decentralized Finance. Learn gradually and increase exposure with experience.

Diversify your assets across platforms. This reduces risk from a single failure.

Follow community updates and platform announcements. Staying informed improves decision making.

Use hardware wallets for better security. They add an extra protection layer.

Conclusion

Decentralized Finance is more than a trend. It represents a major shift in how financial systems operate. By removing intermediaries and using blockchain technology, Decentralized Finance gives users greater control, transparency, and access to financial tools.

For beginners, the learning curve may feel challenging. However, with patience and proper guidance, the basics become clear quickly. Intermediate users can explore advanced opportunities like yield farming and decentralized trading.